This guide explains how to create and deactivate tax rates. It is intended for advanced users.

Local, state, and federal tax rates may change and/or new ones may be implemented. To ensure that you're collecting proper tax amounts, you'll need to make these changes in aACE manually when a new tax rate takes effect. (Note: For tax automation, read about the aACE+ Avalara integration.)

It’s best to first deactivate the current tax profile, then create a new one. You can address part of this effort before the new tax rate takes effect, then complete the update after it takes effect.

Before a New Tax Rate Takes Effect

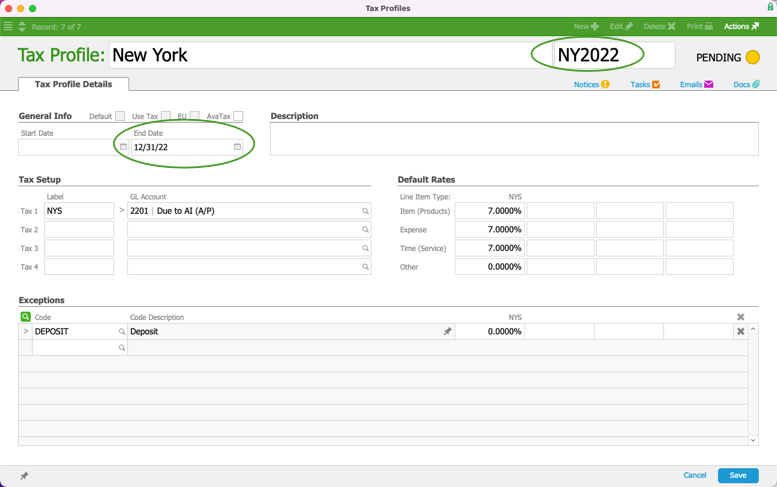

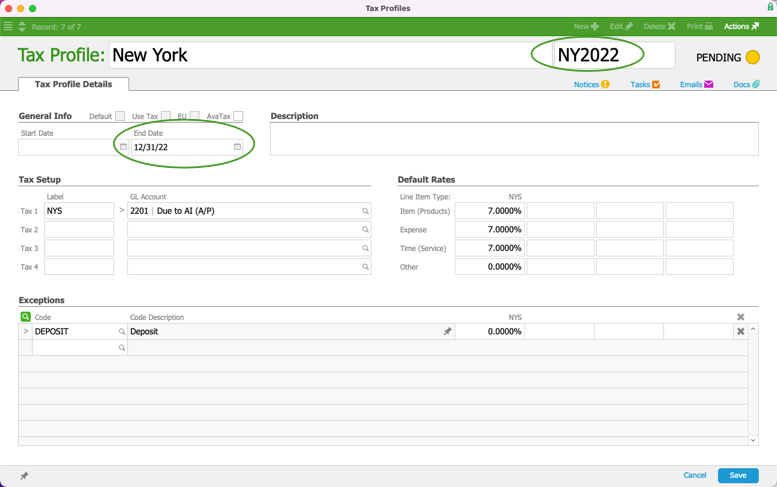

- Navigate from Main Menu > Accounting > Tax Profiles, then select the relevant tax profile.

- At the detail view, click Edit.

- Change the End Date to the last day the current tax rate will be in effect.

Example: If the new tax takes effect on January 1, 2023, you would change the End Date to December 31, 2022. This will trigger a notification on that date, letting you know the tax profile is expiring and will need to be updated. Setting this date will not automatically update the tax profile — it will simply remind you that this process (see next section) needs to be done manually. - Change the profile’s abbreviation to make it clear this profile is out of date (e.g. “x-NY” or “NY2022”). This will allow you to reuse the same code (e.g. "NY") for the new tax profile.

- Click Save.

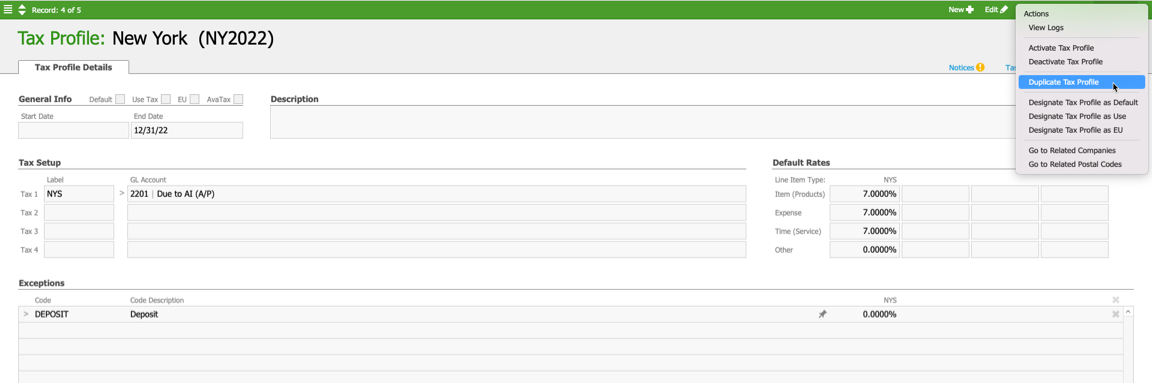

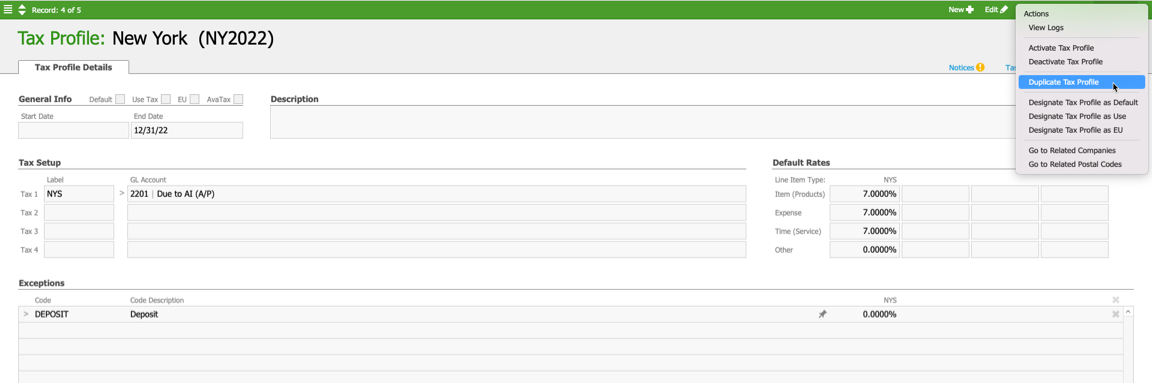

- Click Actions > Duplicate Tax Profile > Duplicate.

- On the new tax profile, enter the basic settings:

- Name — The name from the original profile

- Abbreviation — The abbreviation from the original profile

- Start Date — The day the tax rate goes into effect (e.g. January 1, 2018)

- Enter the new tax rates in the Default Rates section.

- Click Save.

After a New Tax Rate Takes Effect

When you receive the notification you set up with the process above, complete these additional steps:

- Navigate from Main Menu > Accounting > Tax Profiles.

- Select the old tax profile.

- If you have not already done so, complete steps 3-5 above.

- At the detail view, click Actions > Deactivate Tax Profile.

- At the prompt, select Deactivate.

- Make sure to update any related company records, assigning them to the new tax profile created in steps 6-9 above.