This guide explains how to utilize AvaTax. It is intended for advanced users.

After the system administrator configures the AvaTax integration, it is relatively seamless for end users. It can affect orders, invoices, address validation, and tax exemptions.

Changes in Tax Rates

Tax rates change periodically, often at the start of a new year. This may result in differences from the expected tax values. For example, an order may be processed in one year with a certain tax value. If that same order is duplicated exactly in the following year, the tax value might be different. Similarly, if an order is entered in one year, but invoiced in the following year, the tax values could be different.

Orders

When you save an order that includes an AvaTax-enabled tax profile, aACE sends a request to AvaTax for tax amounts for each AvaTax-enabled line item code (LIC) in the order. These tax amounts are stored with the order.

Any edits to the LICs in the order (e.g. changes to the totals) will prompt a new request to AvaTax for an updated tax amount. You can also manually change tax settings by entering Edit mode, clicking the Actions icon ( ) next to the tax information, and selecting an option: Update Tax Profile, Restore Default Tax Profile, or Refresh Tax.

) next to the tax information, and selecting an option: Update Tax Profile, Restore Default Tax Profile, or Refresh Tax.

In the totals section, you can hover over the displayed tax info to display a popup with more detail. With your mouse pointer resting on the tax code (e.g. "CA" in the screenshot above), aACE displays information about the applicable tax profiles. When you hover over the current tax value (e.g. $83.08 above), aACE displays dollar amounts for various subtotals. These summaries can also be helpful in identifying errors that could prevent accurate tax calculations (e.g. a typo in the shipping address State abbreviation).

Invoices

There are many ways that AvaTax interacts with invoices in aACE. Depending on the status of the invoice, the process for translating it into AvaTax can vary.

Invoices in Pending Status

When you save an invoice record with an AvaTax-enabled tax profile to Pending status, an uncommitted sales invoice is created in AvaTax and the initial tax amount is returned. This tax amount is stored with the invoice. Editing the invoice will prompt a new request to AvaTax for an updated tax amount. Deleting a Pending invoice in aACE will delete the uncommitted sales invoice in AvaTax.

When the invoice is changed to Open status, a request is made to commit the sales invoice in AvaTax. If there are any errors, the invoice is kept in Pending status and AvaTax returns a message summarizing the issue (e.g. a typo in the shipping address State abbreviation). After you correct the issue, you can open the invoice.

Invoices in Open Status

In both aACE and AvaTax, an Open invoice cannot be edited. Changes must be entered in aACE as credit/adjustment records, which correspond in AvaTax to 'credit memos'. Saving a credit/adjustment in Pending status will request the applicable tax amounts and create an uncommitted credit memo in AvaTax. Posting a credit/adjustment will commit the credit memo in AvaTax.

To create a credit/adjustment on an invoice, navigate to the desired invoice's detail view, then click Actions > Credit/Adjust Invoice.

Posting Invoices

If an invoice is posted in aACE, but not committed in AvaTax (e.g. due to a connectivity problem or if the AvaTax integration setting in aACE was disabled), you can manually trigger the process: Admin Actions ( ) > Post to AvaTax. This option is not available for already-committed sales invoices.

) > Post to AvaTax. This option is not available for already-committed sales invoices.

Also from the Admin Actions menu, you can select Refresh AvaTax Taxes. This will update a posted invoice to the latest values; any changes will be reflected in the GL. If an uncommitted sales invoice is different from the final version, or if the taxes have changed, the updated tax amount will be returned and stored in aACE.

Invoice Address Priority

When the invoice is committed to AvaTax, it uses the shipping address even if the address noted on the invoice is the billing address. If the invoice was generated directly from a shipment, the address from the shipment is used. If the invoice was not generated from a shipment, then the shipping address on the order is used.

Address Validation

When creating or updating company records, changes to the office address will allow the user to validate the address. If an address is invalid, it does not prevent you from saving the record; aACE simply returns a message identifying the issue.

In orders and invoices, users will be presented with an option to validate the address.

Exemptions

For companies that do business with tax-exempt organizations, you can configure aACE+ AvaTax to automatically mark related transactions as exempt:

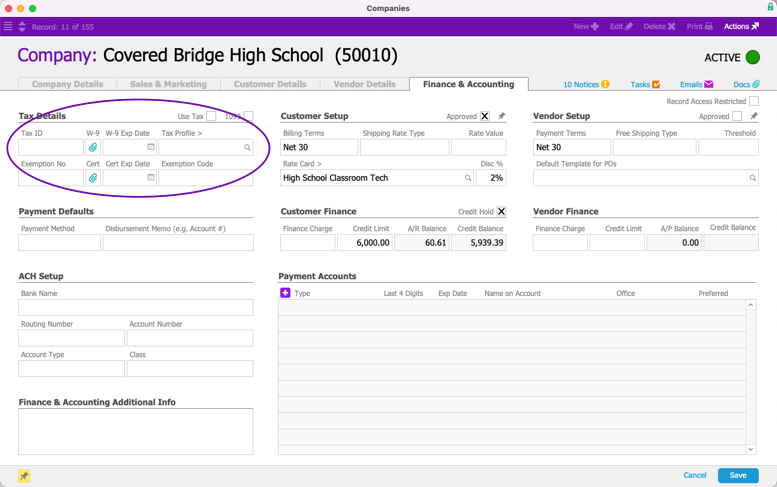

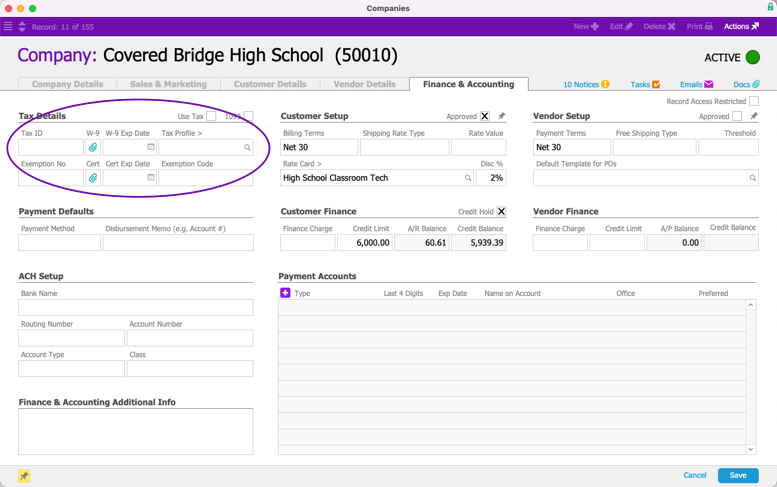

- Navigate from Main Menu > CRM & Sales > Companies and locate the desired organization.

- Navigate to the Finance & Accounting tab, then click Edit.

- In the Tax Details section, fill in the tax exemption details, then click Save.

The Exemption Code field maps to the AvaTax Exemption Reason. The Exemption Number field maps to the AvaTax Exemption Number. Click the Cert field paperclip icon to upload a copy of the organization's tax exemption certificate and provide a certificate expiration date.

CertCapture Integration

aACE also offers an integration with Avalara's CertCapture for managing exemption certificates. For questions about CertCapture, please see Using CertCapture or contact your Avalara representative.