This guide explains how to process a chargeback for credit cards. It is intended for advanced users.

A chargeback typically happens as part of a product return when a customer disputes the charge. The bank issues funds to the buyer, then levies a fee on the seller. Because the bank has already refunded the customer, you should account for the return without issuing a refund (i.e. avoiding a double refund).

- In the Receipts module, locate the Posted receipt for the transaction.

- At the detail view, select Actions > Credit/Adjust Receipt, then at the confirmation dialog, click Continue.

- In the new reversal receipt, enter the actual date of the chargeback for the Deposit On date.

- Click Save, but do not post the receipt. At the confirmation dialog, click Not Yet.

- Click Admin Actions (

) > Post Receipt Without Credit Card Processing, then click Post.

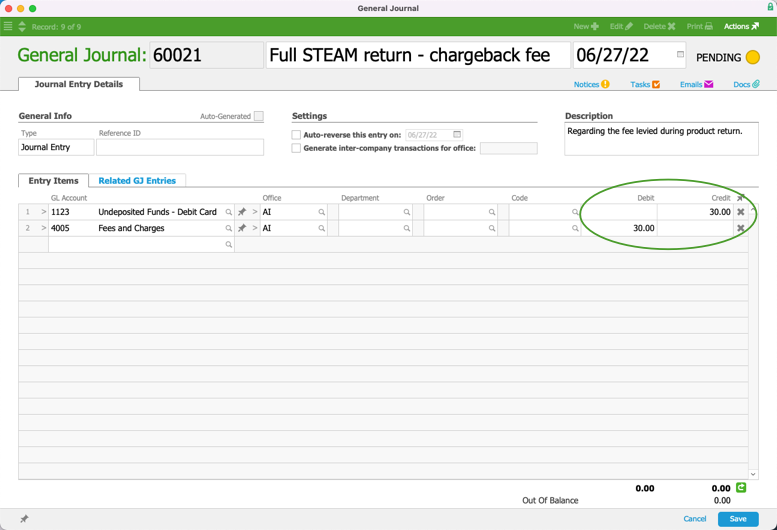

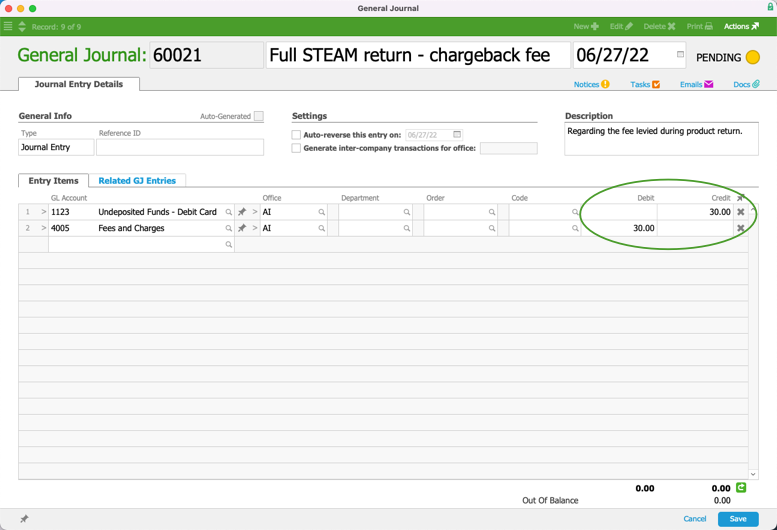

) > Post Receipt Without Credit Card Processing, then click Post. - Navigate to the General Journal module and create a new journal entry to address the chargeback fee:

- Enter data for the journal entry, as needed.

- First entry item — Select the bank account that the fee was taken from, with the full amount of the fee set as the Credit.

- Second entry item — Select another account for the fee, with the full amount set as the Debit.

Note: This account could be one set specifically for chargebacks, refunds, or fees. Consult with your accountant to ensure you are using the most appropriate account for the situation.

- Click Save and Post.