This guide explains how to configure currency conversions. It is intended for system administrators.

When managing international currencies, you should coordinate with the customer or vendor to agree on the exchange rates for your transactions. Many international transactions are completed as wire transfers, with the banks involved handling the currency conversions. aACE has embedded exchange rate features, which are referred to as currency conversion.

Because business transactions can proceed slowly, a currency exchange rate may fluctuate significantly between the start and finish of a transaction. Currency conversion exchange rates in aACE must be entered and updated manually. Before you enable Currency Conversions, you should implement company policies to standardize when your staff will update exchange rates in aACE.

System-Wide Currency Conversions

aACE supports basic currency conversion out-of-the-box. You must enable this preference. Navigate from Main Menu > Accounting > Accounting Preferences > Currency Conversion tab. Select Edit, select Enable Conversion, and select Save.

When enabled, the Currency Conversion preference applies globally. The related fields will be included on all affected records (i.e. orders, invoices, customer receipts, purchase orders, purchases, disbursements, related printouts).

Note: You may need to update your order layout settings to display fields related to international transactions.

Calculating Currency Conversions

Currency conversions are typically calculated from the Purchase Orders and Orders modules. However, you can calculate and apply a currency conversion rate at any of the affected records.

This guide follows a purchase order (PO) to an international vendor as an example.

Currency Conversion Selector for POs

POs drive the currency conversion for their related purchase records. When you create and save a PO from an international vendor, aACE will display a blue Currency Conversion link under the PO Items list:

To update the currency conversion exchange rate, select Edit, then the Currency Conversion link. aACE prompts you to save any changes you have made to your PO, then opens the selector. At the selector, select the desired currency:

You can manually adjust the currency conversion values, if needed. Then, select Save.

These features are also available in Orders.

Currency Conversions by Transaction

If you do not want the full currency conversion features implemented, you can instead create an Other-type line item code (LIC) and use it for currency fluctuation expenses on individual transactions.

On your currency fluctuation LIC, fill out the general information on the Code tab, including any custom prices, vendors, offices, or additional info. On the Setup tab, specify the relevant GL accounts:

If a transaction is affected significantly by currency conversion exchange rates, you can use this LIC to account for the currency conversion.

Example of Using a Currency Conversion LIC

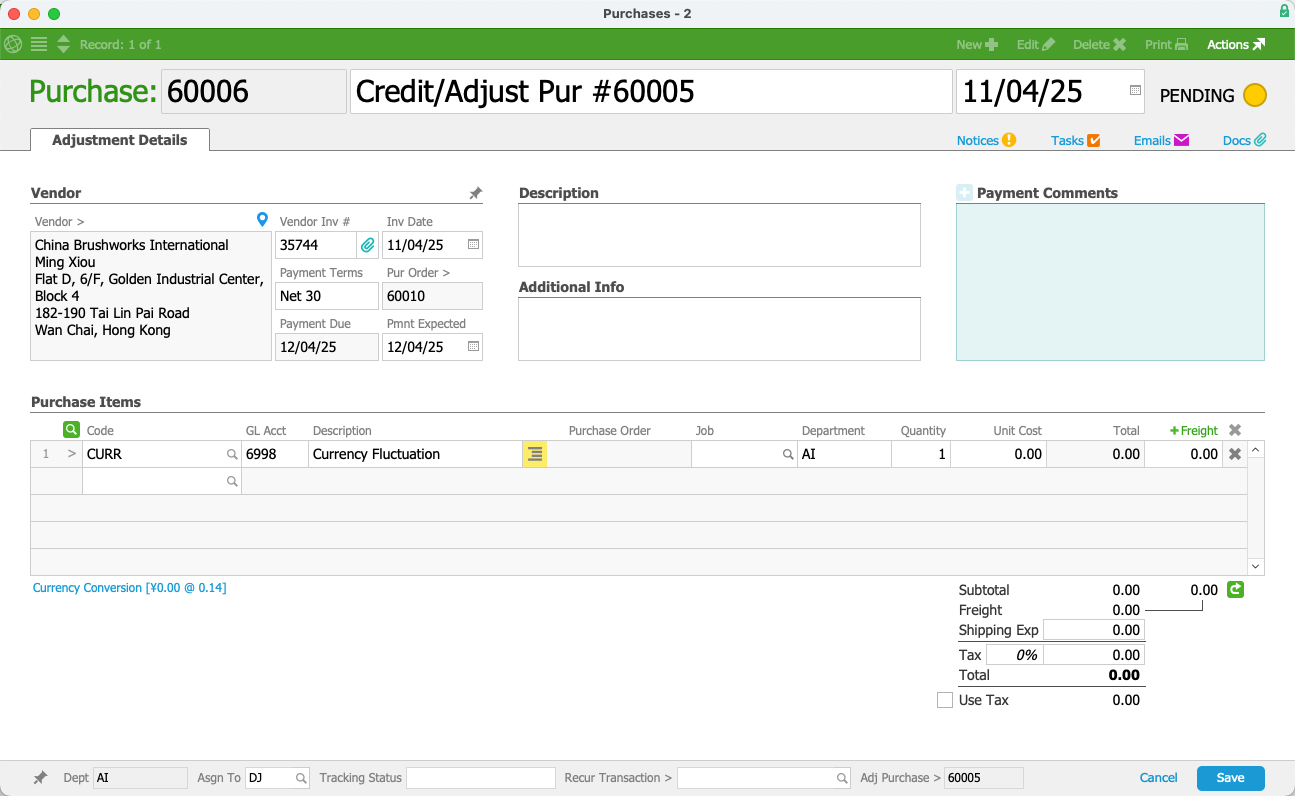

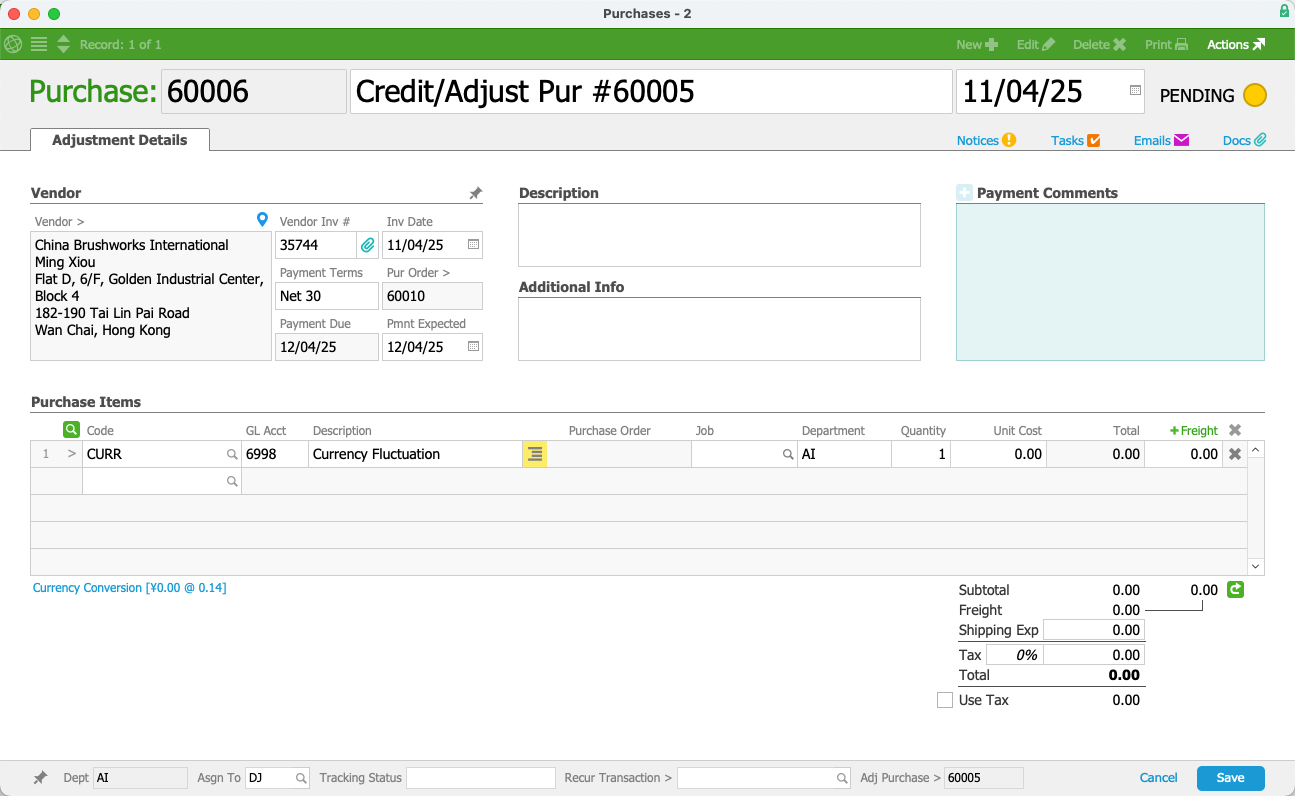

You can apply the currency conversion LIC at a purchase record for an international vendor.

- At the purchase's detail view, select Actions > Create Adjustment.

- Remove the initial LICs, then add the currency conversion LIC as a purchase item.

- Enter the amount to cover the currency change as the Unit Cost.

- Select Save.

aACE applies the currency conversion adjustment to the purchase's initial balance.