This guide explains how to handle refunds for credit card purchases from your vendors. It is intended for advanced users.

When you return items to a vendor, receiving refunds for purchases made with credit cards (CC) must be handled different from other purchases (Refunds on vendor purchases made with cash or check should be handled by creating a refund receipt).

CC transactions with vendors are accounted for in aACE as disbursements. When you return items that were purchased on a credit card, the refund should usually be handled by creating a new, negative disbursement. If you try to handle the refund using a credit card receipt, it will instead activate integrated credit card purchasing.

Be sure to follow your company's policies for returns and refunds, as well as the vendor's policies.

Note: If the refund is for a customer payment made with a credit card, the process requires different steps.

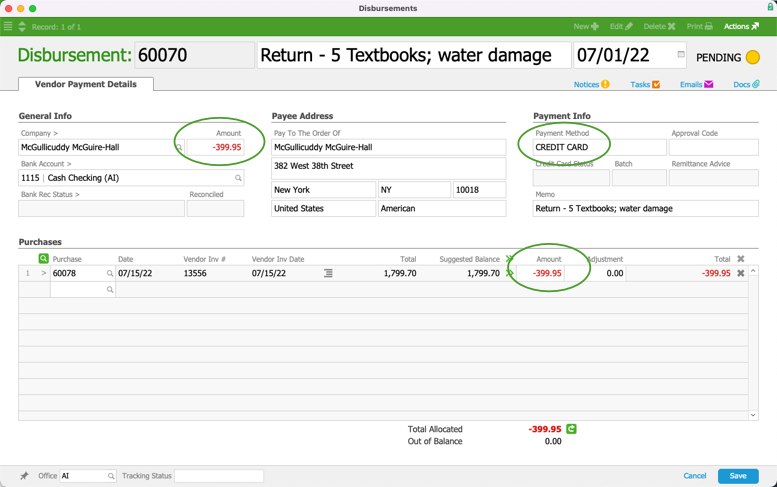

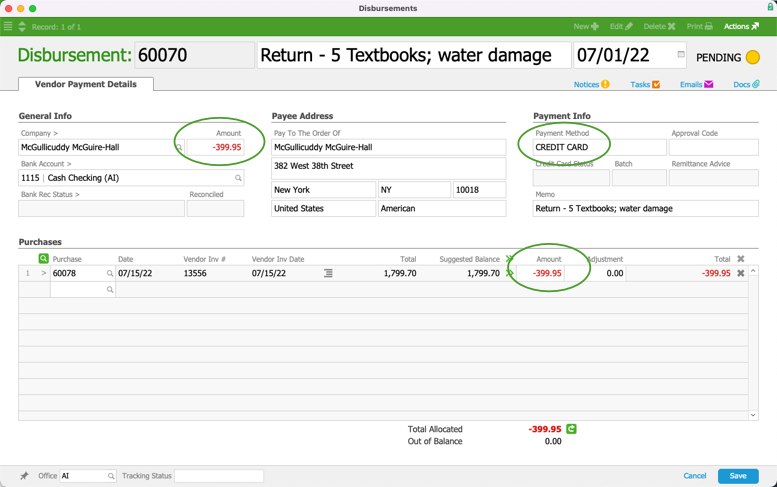

Refund a CC Disbursement with a Negative Disbursement

- Navigate from Main Menu > Accts Payable > Purchases and locate the desired purchase record.

- At the purchase record's Disbursements tab, click the Add button (

).

). - Enter a record title that explains the refund.

- Set the Payment Method to Credit Card.

- Enter the amount of the refund as a negative number in both the General Info section Amount field and the Purchases list Amount field.

- Click Save and Post.

When you post the refund, it will put a balance back on the purchase and re-open the record. You will need to adjust the purchase so it accounts for the change from the refund. This is typically handled by reversing the necessary purchase details with a credit adjustment.

).

).