This guide explains how to pay commissions. It is intended for advanced users.

After you have set up your GL accounts for commissions, you can pay commissions to your team members or to companies who have referred other customers using two methods:

- Create a disbursement

- Create a General Journal entry

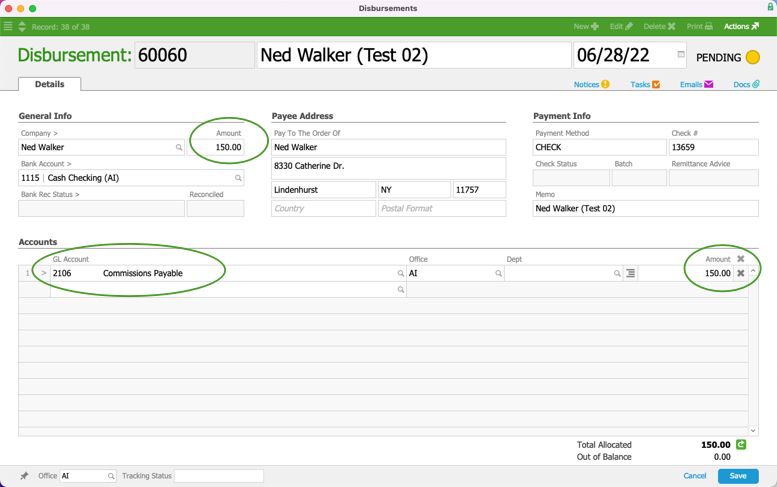

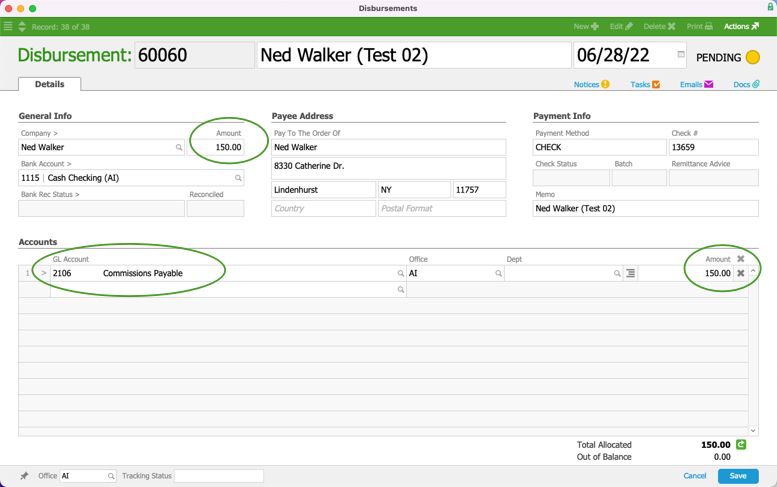

Creating a Disbursement to Pay Commissions

- Navigate from Main Menu > Accts Payable > Disbursements.

- In the menu bar, click New > Other.

- In the new disbursement record, select the entity you want to pay, either the internal company for your sales rep or the third-party company.

- Specify the commission payment in the Amount field.

- For the GL Account line, select the commission liability account (e.g. Commissions Payable) that you want to pay down, then enter the same Amount.

- Click Save, and at the confirmation dialog, click Post.

Creating a General Journal Entry to Pay Commissions

Use this method if your commissions are paid through a third-party payroll service.

If you use this method, be sure you're consistently "paying down" the commissions liability account. When you're doing your General Journal entry for payroll, the line items will account for your payroll, including such things as salary, benefits, and processing fees, as well as commissions.

- Navigate from Main Menu > Accounting > General Journal and create a new journal entry for your payroll.

- Select the commissions liability account in the GL Account field and enter the commission amount in the Debit field.

- Create an offsetting entry item, which will be a Credit against your bank account.

- Click Save.

Note: Your payroll process will typically include more than these few steps for commissions. Check with your accountant for guidance.