This guide shows the ACH Processing Company Portal and the actions you can take within it. It is intended for advanced users.

An ACH transaction is an electronic money transfer made between banks and credit unions across a network called the Automated Clearing House (ACH). ACH payments are possible when a customer gives you authorization to debit directly from their bank account(s). You must first obtain the customer's routing number and account number to use ACH payments.

You can check the status of your ACH transaction, view transaction activity, and manage email notifications through the ACH Processing Company portal. If you receive a return code for one of your ACH transactions, you must take action immediately. For more information on specific return codes and recommended actions, refer to Vericheck ACH return code explanations for R01-R33 and R34-R84.

The payment processor Payment Innovators uses ACH Processing Company to manage ACH transactions within the ACH network. Once your company integrates with Payment Innovators and activates ACH payments, your administrator will be given access to the ACH Processing Company portal. In the portal, you can view and generate reports for transaction activity.

For more advanced features of the ACH Processing Company portal, such as capabilities and reports, refer to the PDF user guide from ACH Processing: ACH User Guide for Client Production Platform 2025_09.pdf

Logging In

To log in, go to the ACH Processing Portal and use the username and password you received previously from Payment Innovators when ACH was set up for you.

We suggest not changing your password. If you do, Payment Innovators customer service may not be able to access your portal to assist with questions in the future.

Adding a User

To add a new user:

- Select Customer Admin, then New User.

- Enter the new user username and password.

- Ensure Active is selected.

- Select the permission level for the new user, then select Submit.

Establishing Email Alerts for ACH Returns

The ACH Processing Portal offers email alerts for your ACH transaction returns. From the main portal menu, select Customer Admin, then select Email Setup. In Select Event, select Return/Change Notification Imported.

To view the default return email, run a test report.

ACH Reporting

The ACH Processing Portal has numerous reports to assist with your transactions, notifications, and processing.

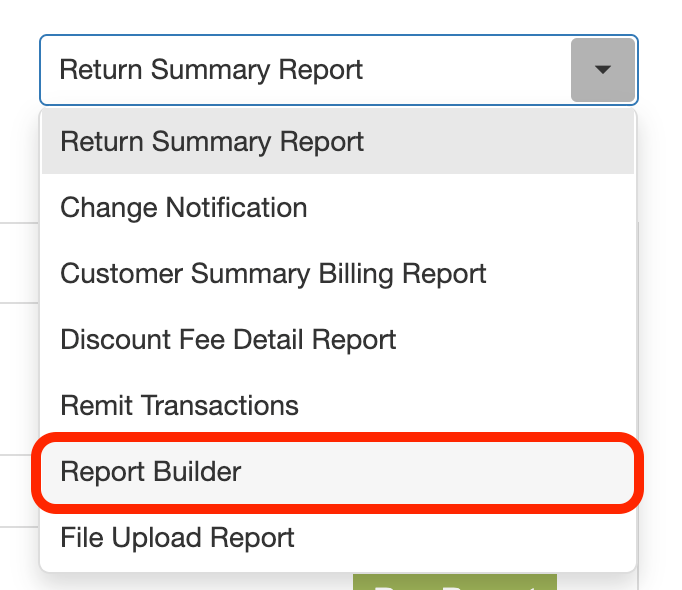

From the main portal menu, select ACHReport.

Enter your login credentials.

In the report dropdown list, select your report.

Report Builder

The Report Builder report provides a custom list of transactions.

Enter the transaction Date Originated Start and End dates. If you leave the rest of the fields blank, the report will display all transactions that occurred within your selected date period. Entering data into the filter fields will constrain the results accordingly.

For example, to constrain results to only those originated through your company, set the SEC Code as PPD. Standard Entry Class (SEC) Codes are three-letter codes that define what type of transaction is being processed and how the authorization was obtained. The SEC code determines several features:

- The format of the entry (e.g. consumer vs. corporate, debit vs. credit)

- Authorization requirements (e.g. written, oral, online)

- Return timeframes, like how long the receiver’s bank has to dispute

There are many common SEC codes.

| SEC Code | Definition |

|---|---|

| PPD | Prearranged Payment and Deposit. For consumer transactions such as payroll direct deposit or paying bills. |

| CCD | Corporate Credit or Debit. For business-to-business payments. |

| WEB | Internet-Initiated or Mobile Entries. For consumer transactions authorized online or through mobile. |

| TEL | Telephone-Initiated Entries. For consumer transactions authorized verbally over the phone. |

| ARC | Accounts Receivable Entry. For checks converted to ACH at a lockbox or the point of sale. |

| BOC | Back Office Conversion. For checks converted to ACH in the back office, not at the point of sale. |

| RCK | Re-presented Check Entry. For a bounced check represented electronically. |

| POP | Point-of-Purchase Entry. For checks converted at the point of sale. |

When you select Run Report and you receive your report, review the Status column:

- Pending — New transactions, waiting to close at end of day

- At SB — At service bureau. Typical status for days 2-4 of processing

- SB Remit — Funded to the bank

- Returned — Must take action

Return Summary Report

The Return Summary Report gives a list of transactions that generated failures (i.e. returned checks, insufficient funds, bad account number). Select the date range for the transactions, then select Run Report. On the report, the Reason Code column displays a return reason code. The return codes determine the type of action you should take.

For more information on ACH return codes and explanations, refer to ACH Return Code Explanations.

Remit Transactions Report

The Remit Transactions report is a list of transactions that have deposited into a bank account. This report shows transactions originating at the service bureau with a status of File Transmitted. This means the service bureau has completed depositing funds.

Manually Entering a Transaction

If you need to manually enter a transaction directly from the portal, you can do so following these steps. For more advanced transactions refer to the PDF User Guide at the top of this article.

- Select Transactions, then Input Transactions.

- Select the SEC Code PPD and enter transaction Entry Description.

- Select the account type.

This displays the options Debit (pulling funds from an account) or Credit (sending funds to an account) - Select Automated Withdrawal (or Deposit) for Action Subtype.

- Enter the Routing Number, Account Number, Amount, and Company/Individual Name fields.

Other fields are optional but may be used to transmit the required information. - Proceed to Transactions/Approval to review and approve the file.