This guide explains the process for deactivating tax profiles. It is intended for system administrators.

You may need to deactivate tax profiles due to updated tax rates or as part of the AvaTax setup. To properly deactivate a tax profile, you must remove the tax profile from related postal codes and company records, then deactivate the tax profile.

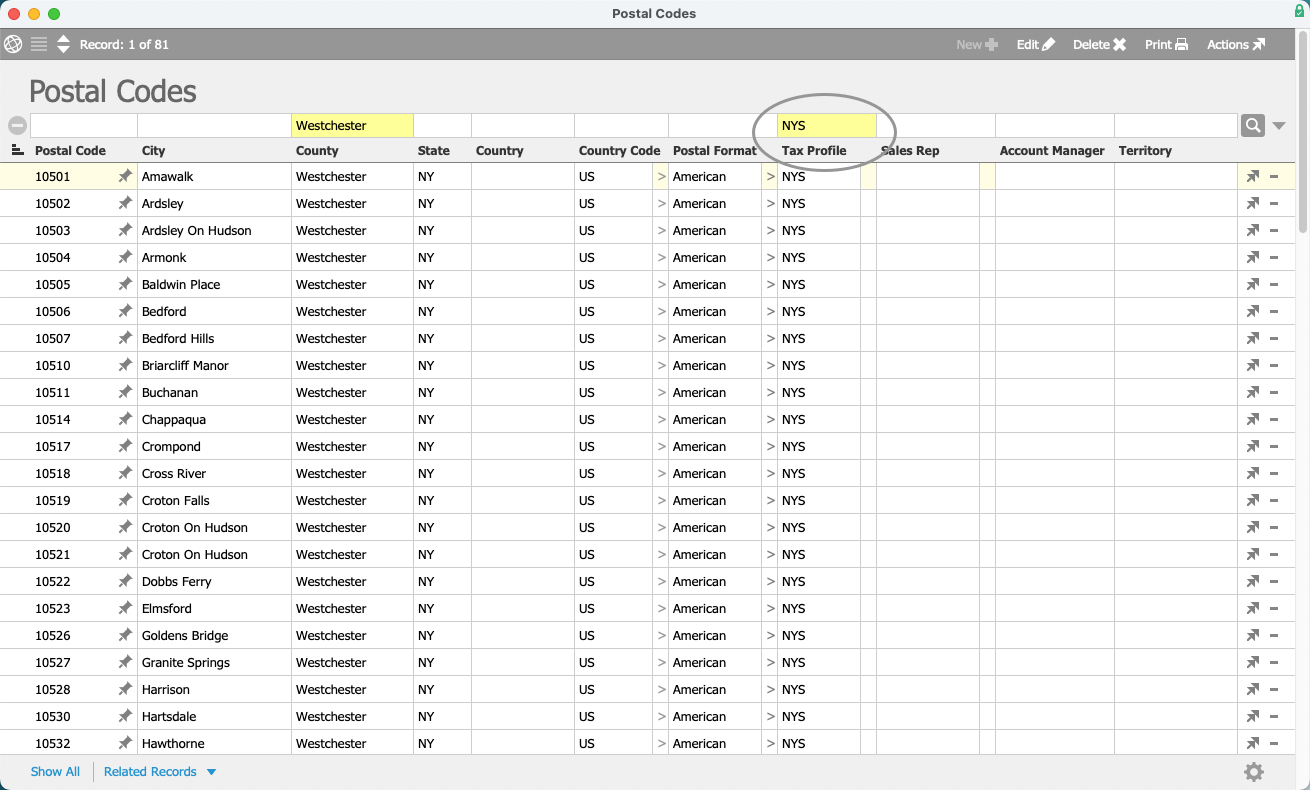

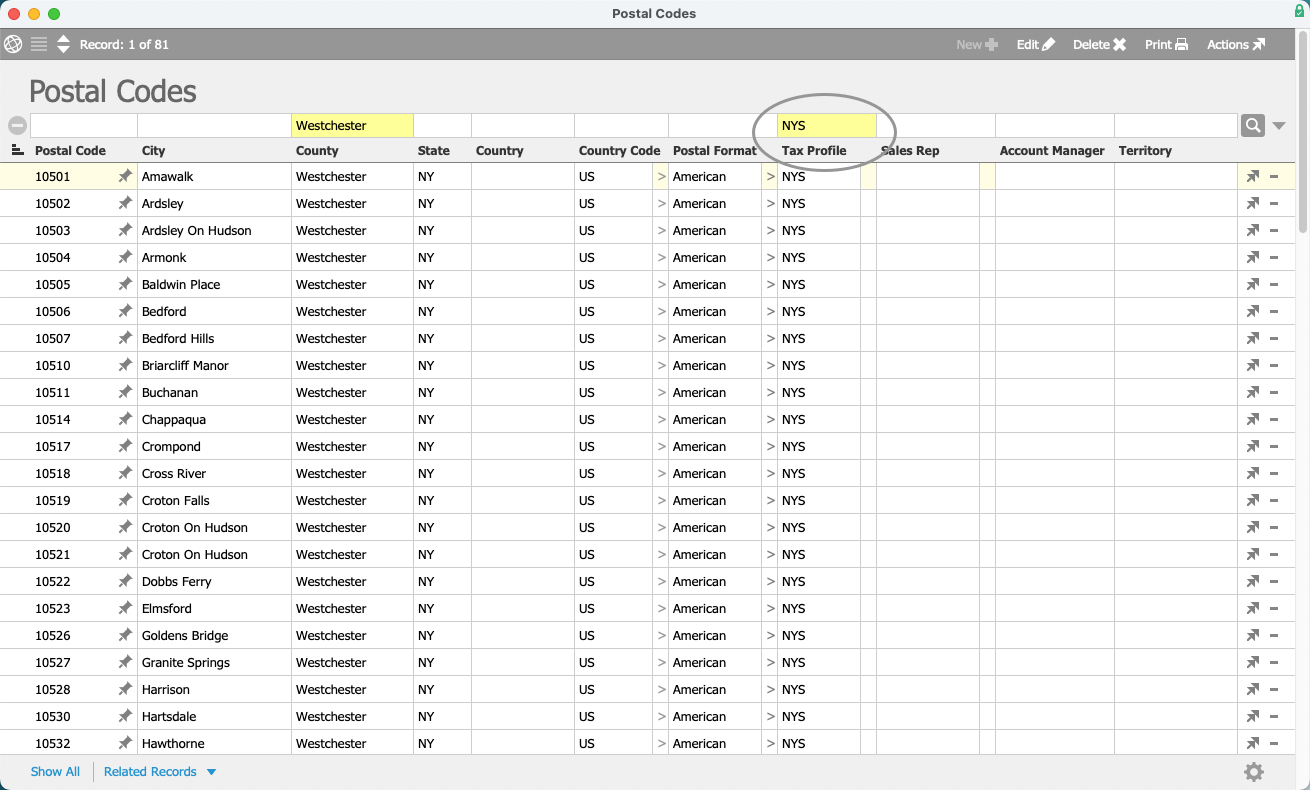

Remove Tax Profiles from Postal Codes

- From the Main Menu, go to System Admin > Postal Codes.

- Use the Quick Search bar to locate the postal codes you want to clear.

You can search by the Tax Profile field to locate postal codes with linked tax profiles.

- Select Edit > Update Tax Profile for List.

- Select Clear.

aACE will remove any tax profiles that are linked to the postal codes in your list.

Remove Tax Profiles on Company Records

You can perform a batch search and update to remove tax profiles from multiple company records. Ensure you review each company record before removing the tax profile to avoid removing other important tax profiles (e.g. tax exempt).

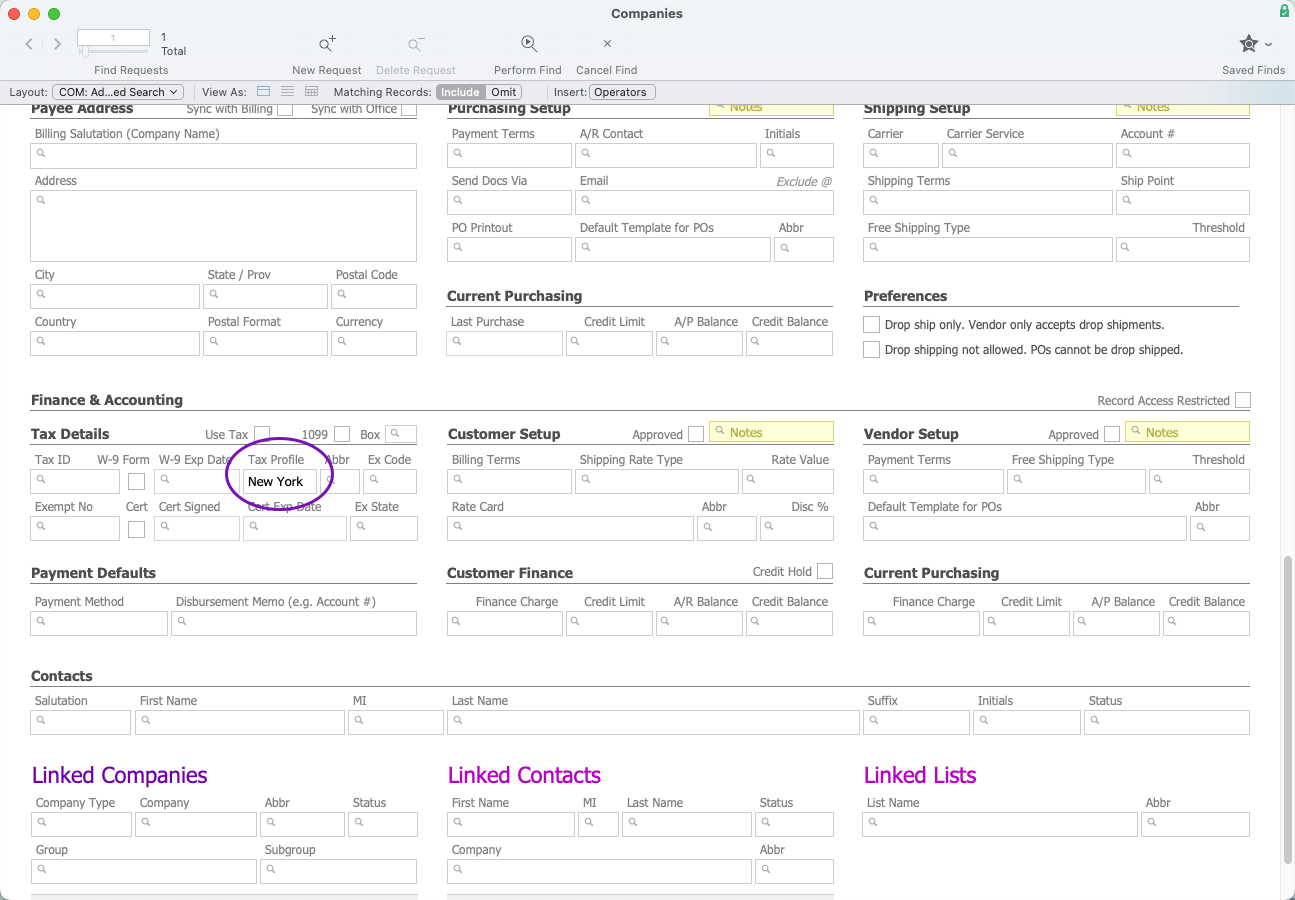

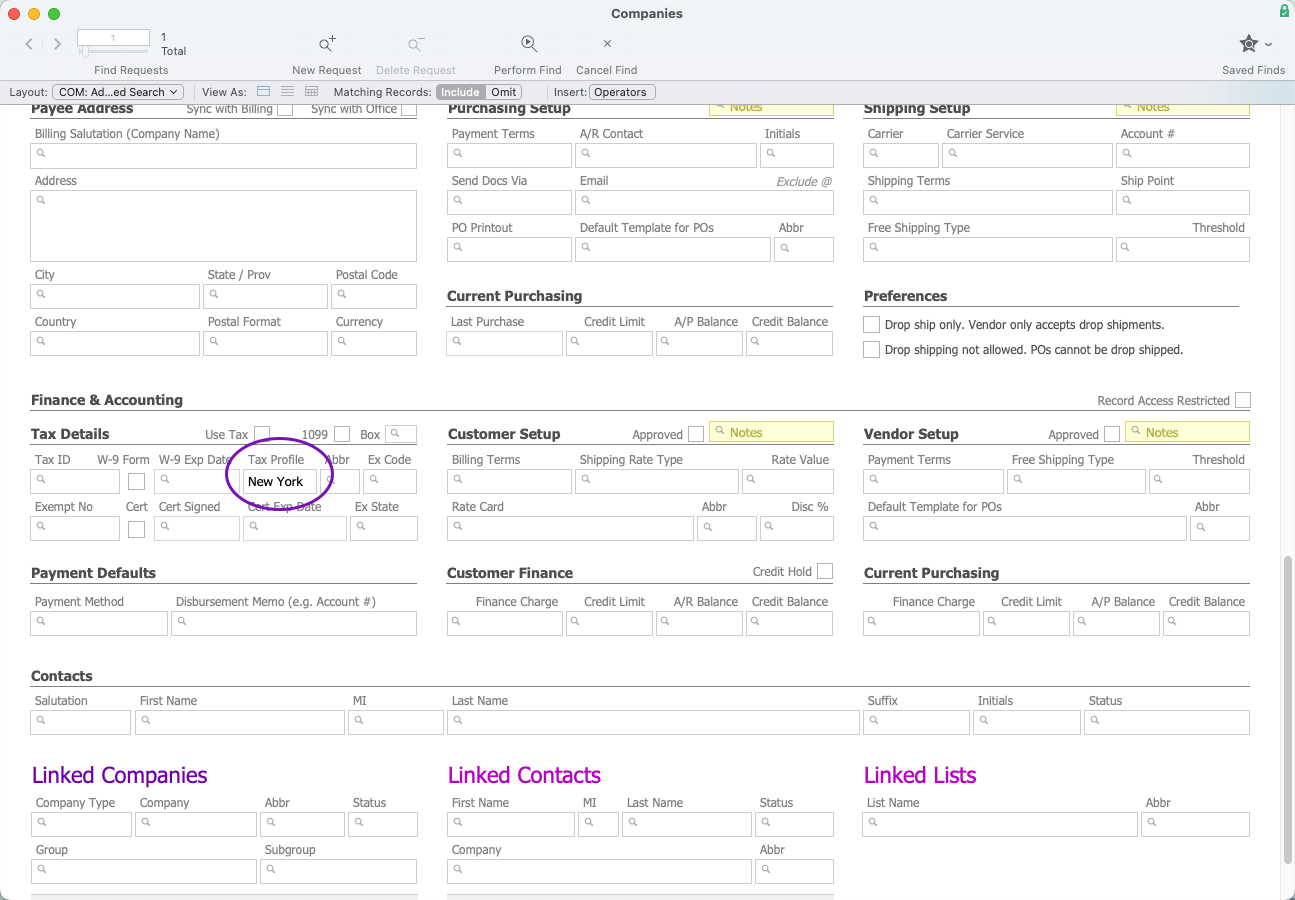

- From the Main Menu, go to CRM & Sales > Companies.

- Select the Search Options icon (

), then select Go to Advanced Search.

), then select Go to Advanced Search. - In the Tax Details settings, enter values for Tax Profile or Abbr.

- Select Perform Find.

- Select Edit > Update Tax Profile for List.

- Select Clear.

aACE will remove any tax profiles that are linked to the company records in your list.

Deactivate Tax Profiles

You can only deactivate a tax profile if there is not a linked postal code or company record. If a postal code or company record is linked to the tax profile, aACE will not deactivate it and explain the reason.

- From the Main Menu, go to Accounting > Tax Profiles.

- Use the Quick Search bar to locate the tax profiles you want to deactivate.

- Select Actions > Deactivate List.

- Select Deactivate.

), then select Go to Advanced Search.

), then select Go to Advanced Search.