This guide describes identifying and correcting accounts receivable errors. It is intended for advanced users.

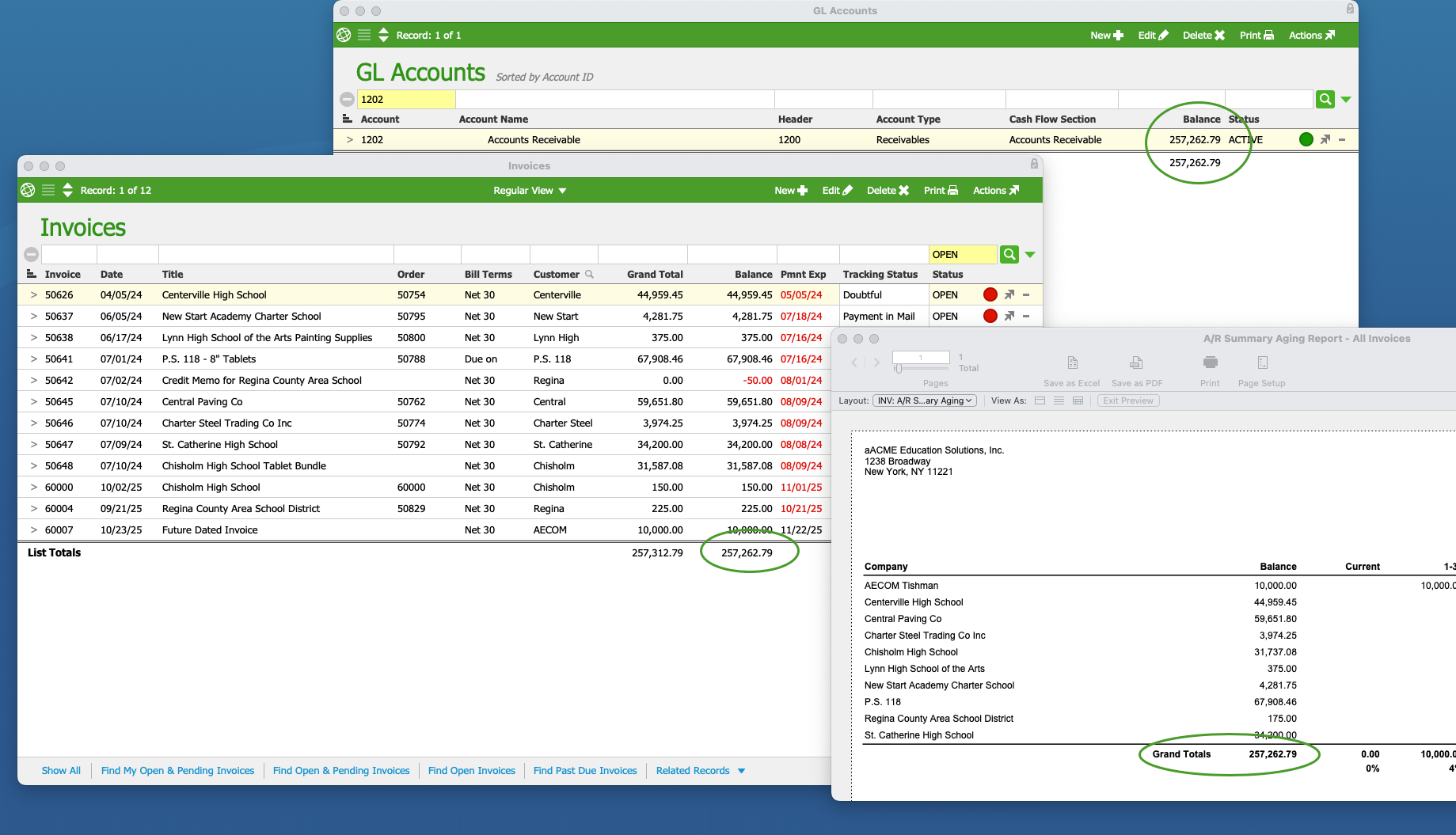

If your accounts receivable (A/R) numbers do not align, there are a few ways you can audit them in aACE. For your A/R numbers to be correct, the A/R general ledger (GL) account, the total balance for all open invoices, and the grand total for the summary aging report for all invoices as of the current date should all have the same values. If the values on these records and report do not match, you must locate and correct the errors by auditing the A/R balance.

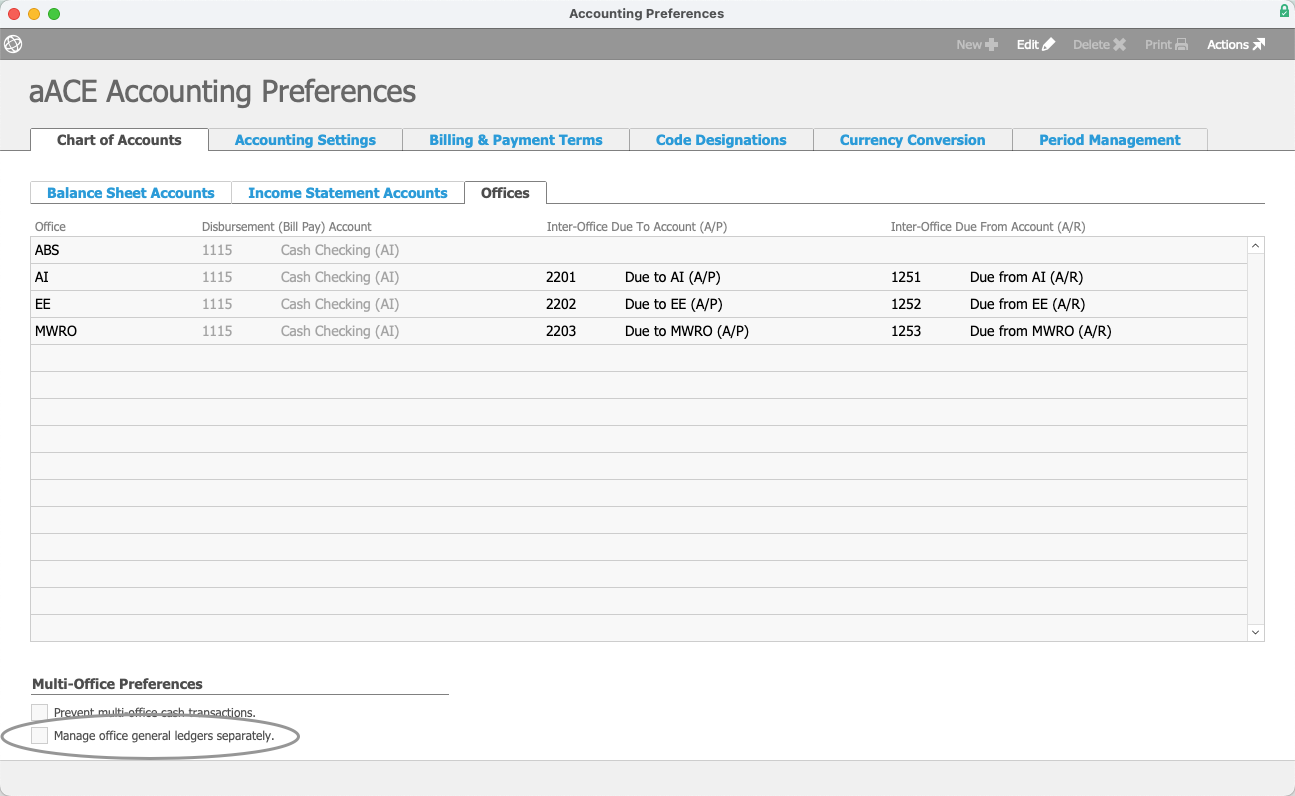

Before auditing A/R, ensure your Chart of Accounts preferences are correct. The GL Accounts module will display different values depending on multi-office preferences. If your totals for all open invoices and the A/R GL account are showing different numbers, it will cause auditing mistakes.

From the Main Menu, go to Accounting > Accounting Preferences > Chart of Accounts > Offices. In Multi-Office Preferences, enable or disable Manage office general ledgers separately. This preference will ensure you are comparing the right numbers (e.g. not comparing the A/R balance for all offices against open invoices for one office).

Invoices with Future Dates

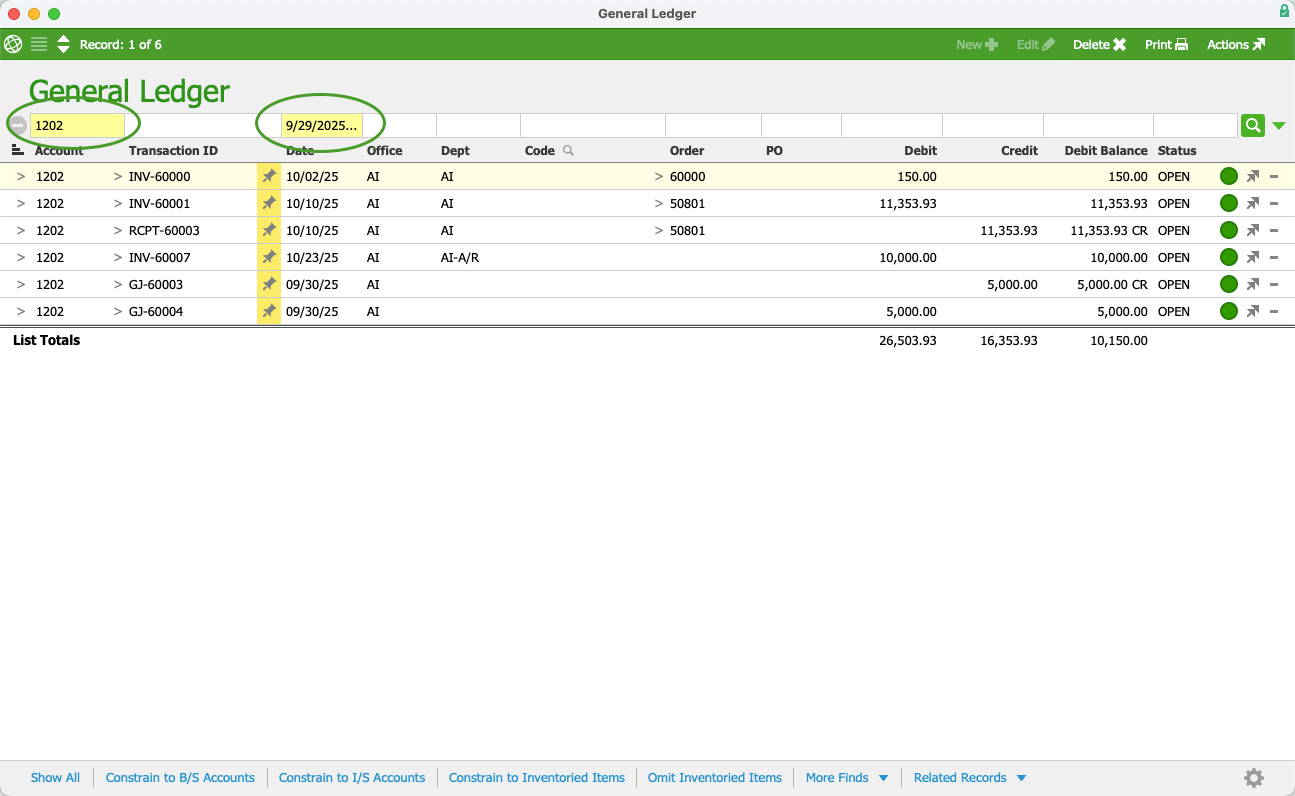

If an invoice record has a date that is in the future, a reconciliation as of the current date will not include that future invoice. In this case, the values for the A/R GL account and the total for all open invoices will match, but the summary aging report for all invoices as of the current date will not.

To locate the specific invoice(s), go to Accounting > General Ledger. In the Quick Search bar, enter the A/R account number and then the current date followed by "...". For example, for a date of September 29, 2025, the Quick Search entry would be "9/29/2025...". Using this search format will filter all invoices to ones dated for the current date and in the future.

After you have located the proper dates of the future invoices, you can run a new summary aging report for all invoices with the farthest date. For example, if you have an invoice dated in two days and one dated in four days, enter the date in the aging report for the invoice dated in four days. If this error was the reason for your A/R discrepancies, the new summary aging report for all invoices with the future date will show the same value as the A/R GL account and the total for all open invoices.

Manual General Journal Entries

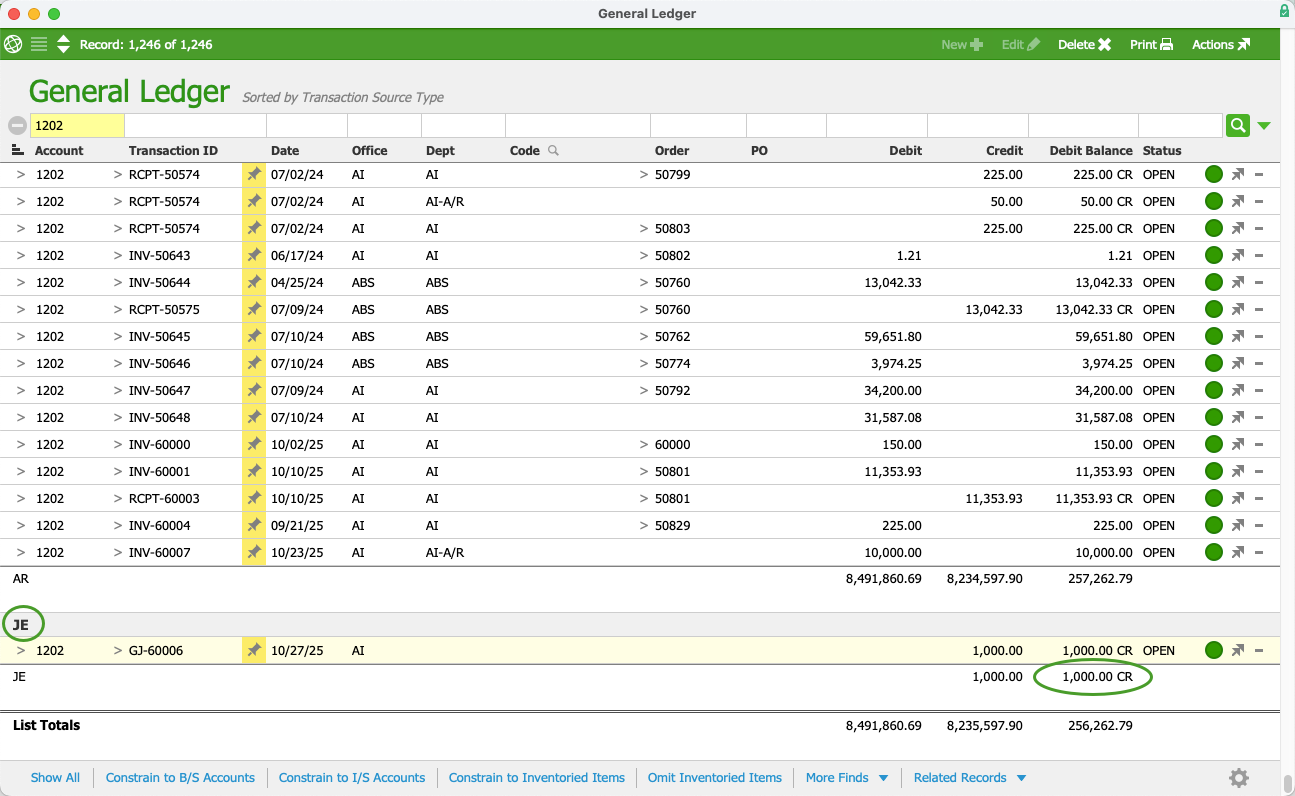

Team members may occasionally adjust the value of the A/R account using a general journal entry. However, because this is not an accounts receivable transaction (e.g. invoice or customer payment), the entries can cause variances. For example, if a user creates a general journal entry to account for bad debt, the total of all open invoices and the total for the account debit balance in the GL will not be the same.

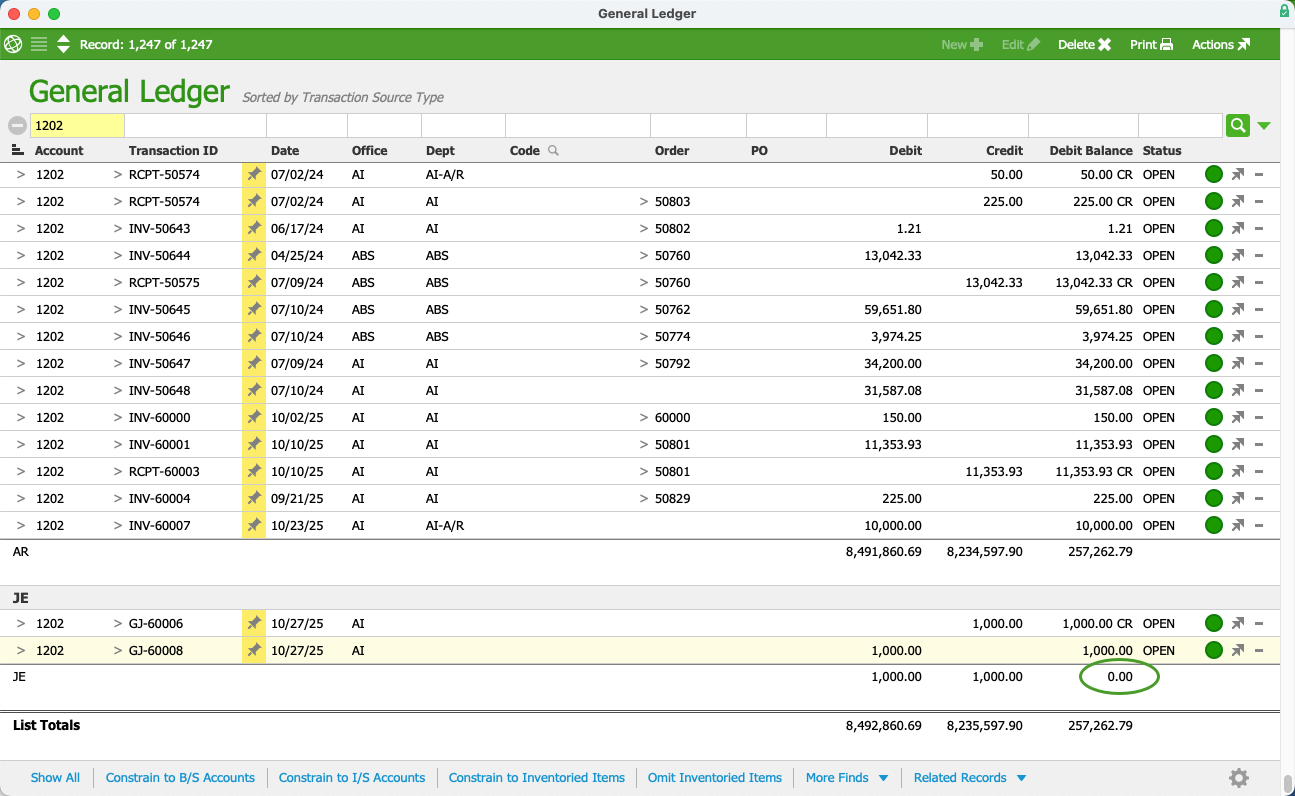

You can search the GL by transaction source type to identify the transaction that is not A/R. Go to Accounting > General Ledger. Use the Quick Search bar to search the GL by the A/R account number. Select the Sort icon ( ), then select Transaction Source Type. This will sort all the GL entries by their source type.

), then select Transaction Source Type. This will sort all the GL entries by their source type.

If there is a transaction that is not an A/R entry, it will appear under a different source type than AR. If the entry was from a general journal entry, the transaction will appear under the source type JE.

After you have identified the offending transaction, you can void the record or reassign the GL account for the transaction. The debit balance for the JE entries should be zero after you void the transaction and the voided JE transaction should appear in the general ledger list.

Revenue Entries to A/R Account

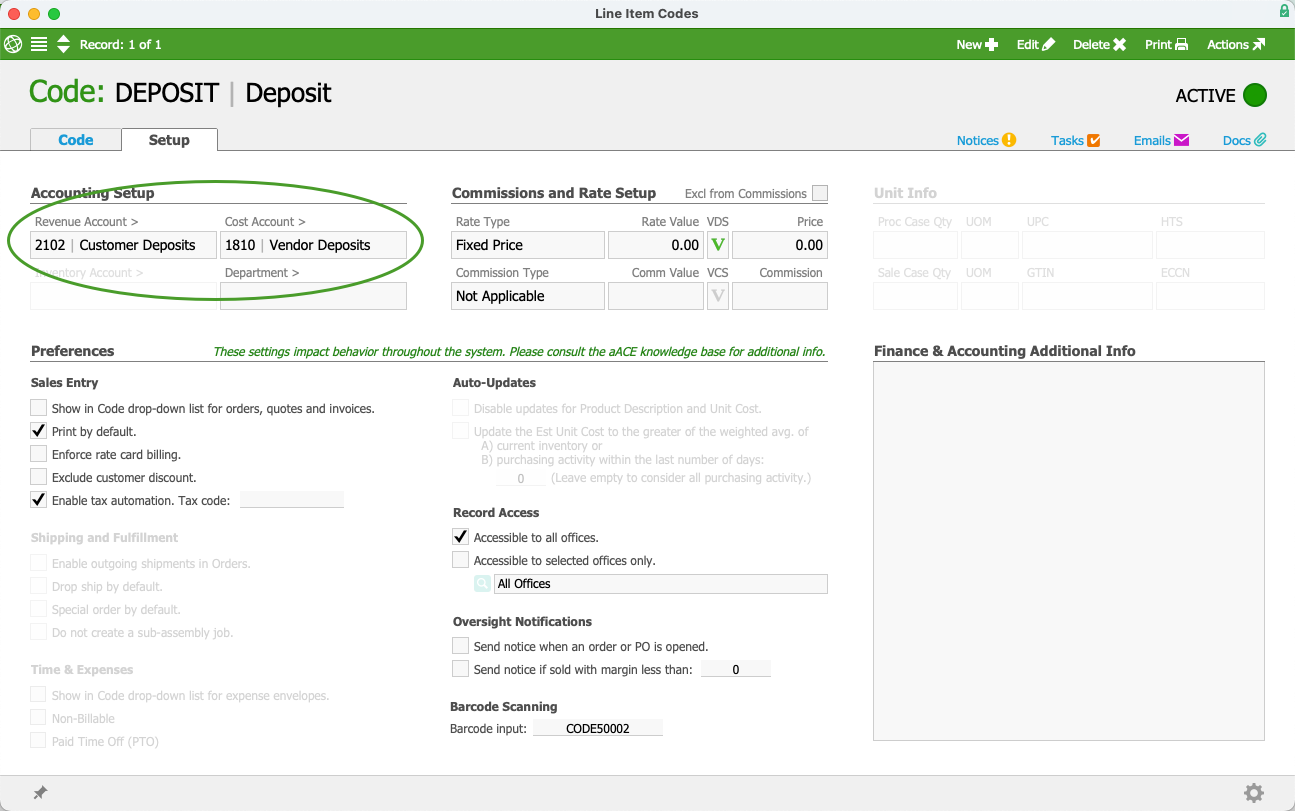

The A/R account should not be the designated revenue account for a line item code. This can cause discrepancies for your A/R balance. For example, deposits should have their own liability account. However, team members may assign an A/R account to a deposit line item code. The transaction and the line item code must be corrected.

To locate discrepancies, go to General Ledger > Search Options icon () > Go To Advanced Search. In the Advanced Search, enter the Accounts Receivable ID in the GL Account ID field and an asterisk (*) in the Code field. This will search for entries that use a line item code with the A/R account linked to it.

You can correct the GL account for the line item code(s) by navigating to the General Ledger > searching for entries with discrepancies > Admin Actions > Update GL Account for List from Line Item Codes. aACE will update the GL account linked to the line item code. Then, you must reassign the GL account for the entries. For more information on this process, refer to Reassigning GL Accounts for Posted Transactions.

Reassigned GL Account

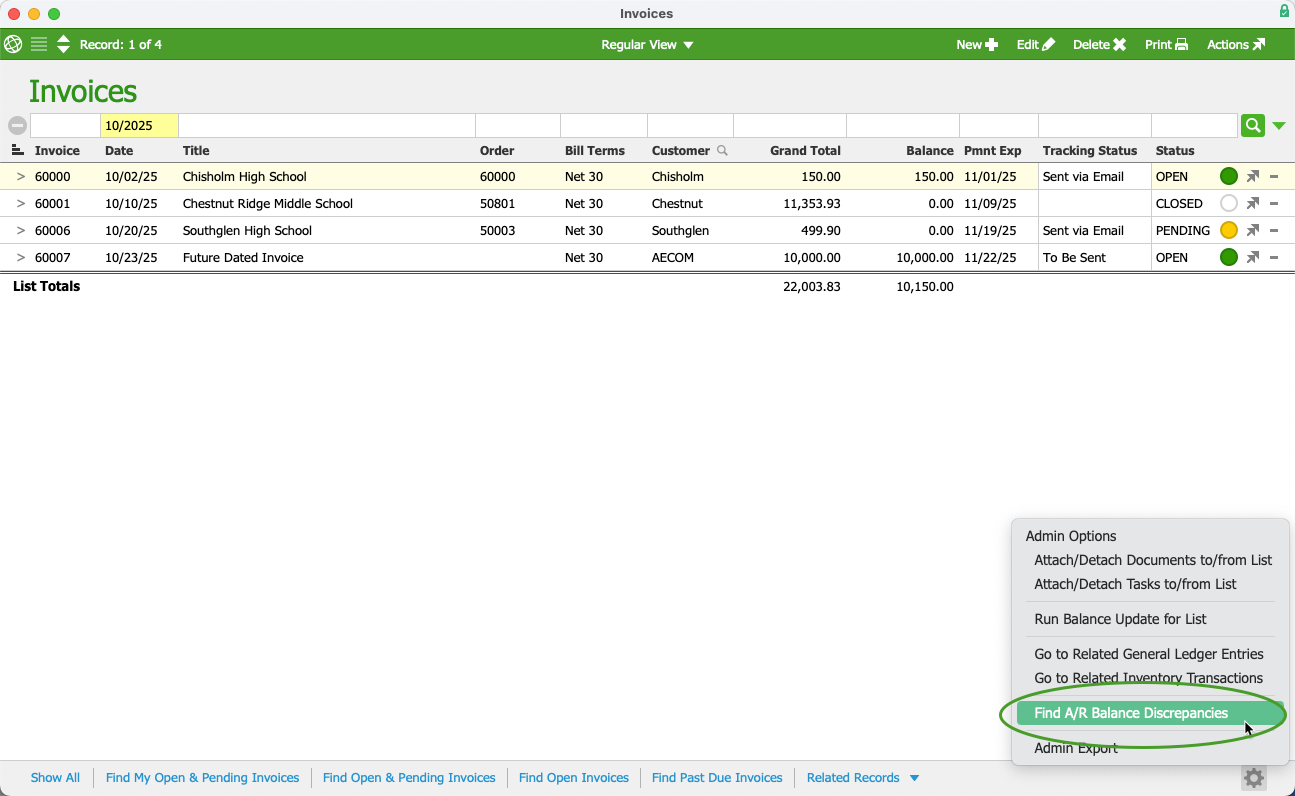

If a team member reassigns the GL account for an A/R entry, it will cause variances. If you are unable to identify where the error occurred, go to Accts Receivable > Invoices. In the Quick Search bar, search the invoices by date beginning with the current month. After searching by a month, select Admin Actions ( ) > Find A/R Balance Discrepancies. Repeat this process beginning with the current month until discrepancies are found.

) > Find A/R Balance Discrepancies. Repeat this process beginning with the current month until discrepancies are found.

If you know the month that the error occurred in, begin the date search with that month. aACE will display any invoices with discrepancies.

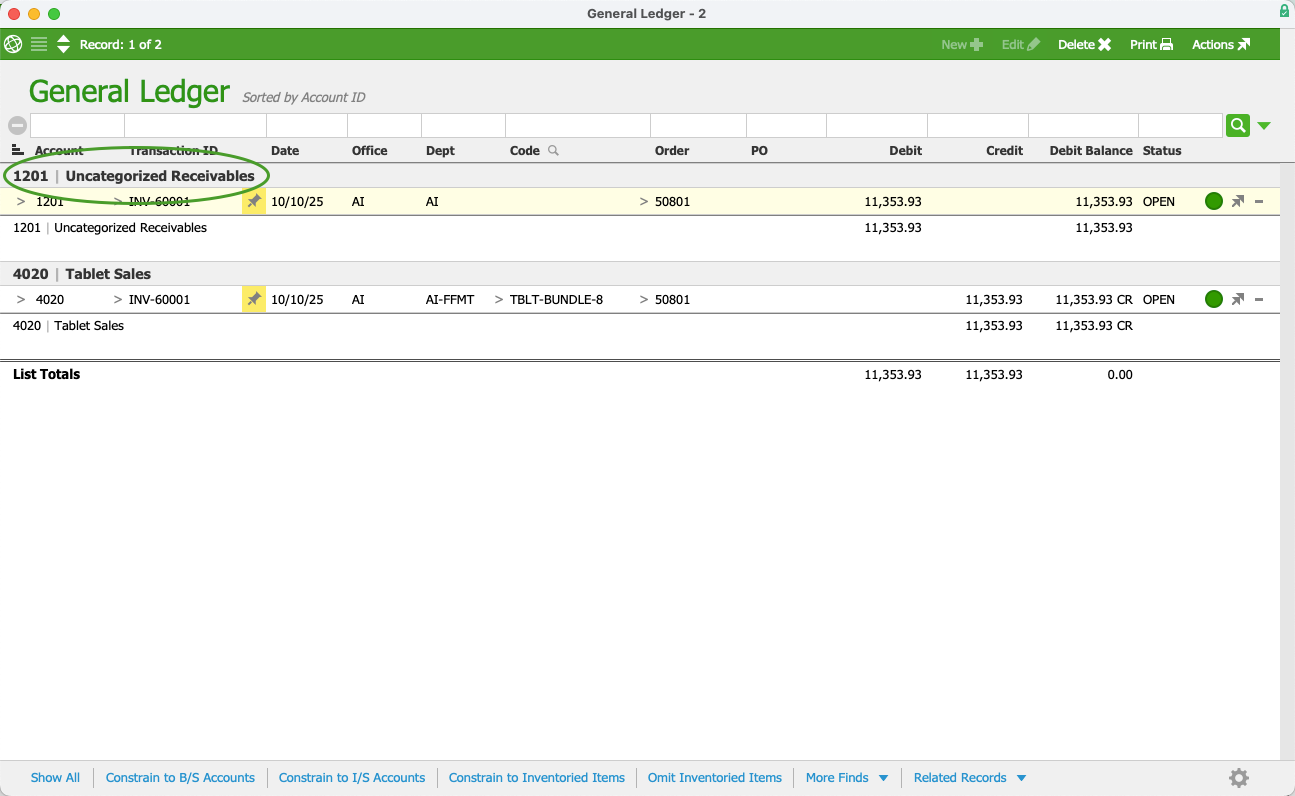

When discrepancies are found, you can view the invoice record and select the record Admin Actions > Go to Related General Ledger Entries > sort by Account. By sorting the entries by account, you can see any entries that are not assigned to A/R.

To correct the discrepancy, assign the GL entries to the A/R GL account.

Other Errors

If the A/R error is not any that are previously listed, contact your system administrator with information about the records you're working with, what you've tried, and any other details that could be used to identify the issue.