This guide explains sources for bank statement discrepancies and how to fix them. It is intended for system administrators.

Warning: Before you begin this step of entering beginning balances, it is essential that you read this guide in its entirety — you must understand the process before beginning the process.

After you have migrated all your previous system's transaction data, you are able to reconcile bank transactions.

Bank statement reconciliation is the process of comparing your bank balance (totals shown on the bank records) to your book balance (totals shown in your accounting system), then accounting for any discrepancies.

Causes of Discrepancies

Discrepancies between these two balances are typically caused by transit time.

For example, cutting a check updates your accounting system immediately. It deducts the cash and reflects that transaction on the book balance. However, your bank balance will not reflect the check until the payee receives it, deposits it, and it clears the account. Likewise, for recording a receipt, the deposit record updates the book balance immediately, but funds are not available as cash until you physically take the receipt to the bank and it clears.

We recommend that you try to minimize the number of checks and deposits in transit at your Go-Live Date. You can simplify the go-live process by rescheduling your invoicing and bill payment around that date.

Other causes for discrepancies can include transaction fees, automated bill payments, interest deposits, etc. Generally these transactions are identified during your bank statement reconciliation process, then entered into your accounting system retroactively. This aspect of business operations is a good reason to keep your bank accounts reconciled.

Reconciling Discrepancies Between Transaction Records

Generate a bank statement reconciliation from your previous system. Confirm that the bank statement reconciliation is accurate. The report should list all outstanding checks and deposits.

Next, use the aACE Bank Reconciliation module to verify you have records for all the outstanding transactions listed on your bank statement reconciliation.

If your bank statement shows additional entries, you may need to create additional transactions in aACE. The Bank Reconciliation/Statements module provides Quick Links to help you easily create additional records for a reconciliation.

Confirm the Bank Reconciliation

After you create any needed disbursements or receipts, you can finish the reconciliation.

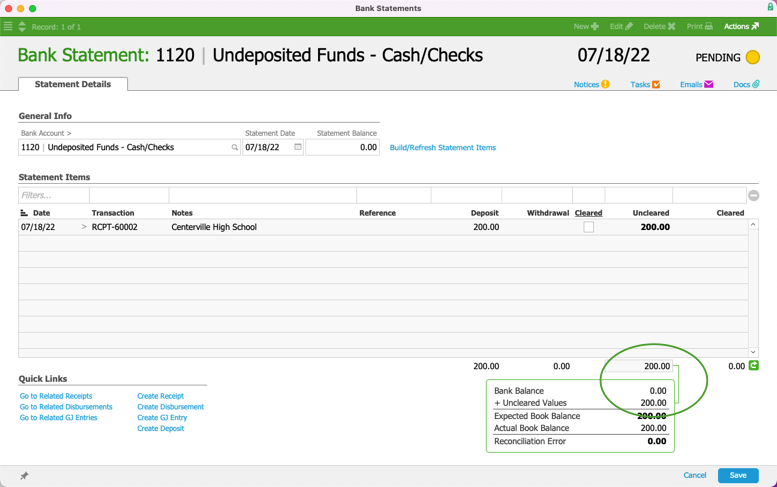

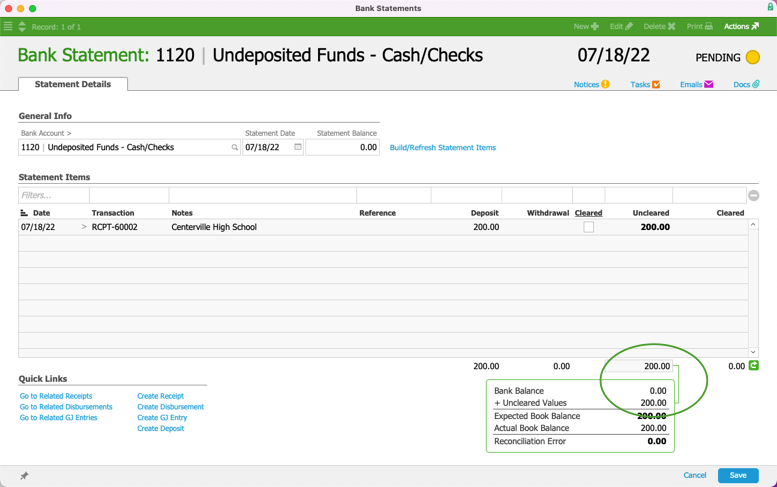

- Navigate from Main Menu > Accounting > Bank Reconciliation, then click New.

- Enter the Bank Account and Statement Date.

- Click the link to Build/Refresh Statement Items.

- Verify that the Uncleared Values amount matches the corresponding value in your previous system's bank statement reconciliation report. If these two amounts do not match, then you must reconcile the two systems. Otherwise, continue to the next step for beginning balances.

Note: Do not worry about the amounts for Bank Balance, Expected Book Balance, or Actual Book Balance. These will not be accurate until after you complete the entire beginning balance process.